Key points from the government's new coronavirus support plan

Posted on 24th September 2020

Earlier this afternoon Chancellor Rishi Sunak once again took to the podium in the House of Commons as he delivered yet another speech in which he outlined the government's response to the continuing coronavirus pandemic.

Further restrictions were announced by Prime Minister Boris Johnson earlier this week including a 10pm curfew for bars, restaurants and pubs nationwide, with it now becoming mandatory to wear masks in all indoor hospitality institutions when not seated. Wedding guests have been limited to just 15 guests, and the country has been warned that these new restrictions could be in place for the next six months.

Here are the key points from the Chancellor's speech...

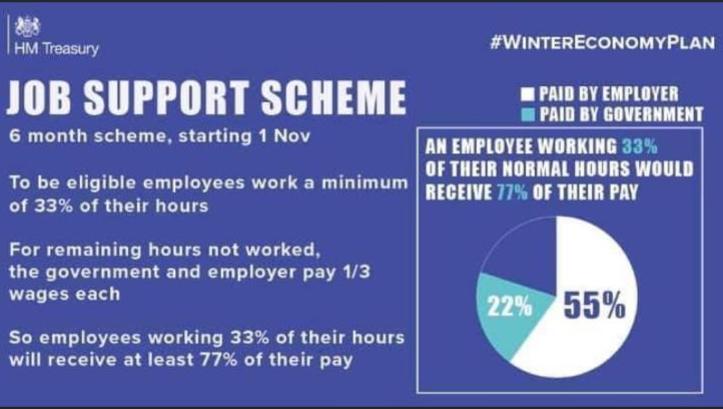

Perhaps the most significant announcement was that of a new coronavirus job support scheme, which will replace furlough. This scheme will see the government directly support the wages of people in viable jobs working at least a third of their normal hours.

We expect more detailed information about how to apply and eligibility criteria to be released in the next couple of weeks, but what we know so far is the following:

The government will top up a third of an employee's salary that would have otherwise been lost as a result of working reduced hours

This top-up will be capped at £697.92 a month

The scheme is due to start on November 1 2020 and run for six months initially

All small and medium-sized businesses will be eligible for the scheme

Larger businesses will have to prove that their profits have been negatively affected by the COVID-19 pandemic in order to apply for the scheme

No business will be able to make any of their employees redundant while they are taking part in this scheme

Furthermore, the previously announced self-employed grant will be extended on similar terms as this new support scheme, but again, we are waiting for more information about this.

Other measures announced earlier today include a 'pay as you grow' scheme which has been designed to allow companies more time to repay bounce back loans over a period of up to 10 years rather than six, which was the original plan.

This will help companies that are struggling to these loans back, as they will now be able to choose to make interest-only repayments. The Chancellor said that anyone who is significantly struggling can suspend repayments altogether for up to six months.

VAT will remain at 5% for the hospitality and tourism industries until 31 March 2021; it was initially going to revert back to 20% in January 2021, so this will likely be welcomed by those secotrs.

Finally, the deadline for taking out a coronavirus business interruption loan will be extended until 30 November 2020, and the government guarantee on them extended for up to 10 years. This is also a welcome improvement on the initial plans.

Next steps

If you're struggling to get your head around the constant changes, you're certainly not alone. Please feel free to join our dedicated coronavirus Facebook support group here. This is free for both clients and non-clients. You can also access our coronavirus support hub on the website here, which has heaps of free resources and information which we update regularly.

Written by

Nicola J Sorrell -

Effective Accounting

Founder | Xero Champion | IR35 Expert

Tagged as: Coronavirus

Share this post: