What is Pension auto-enrolment?

Posted on 19th August 2021

Auto-enrolment is a government scheme which was introduced and rolled out to all employers starting in October 2012. Since February 2018, every single employer in the United Kingdom is legally obliged to enter their criteria-fitting employees into the scheme.

The programme was introduced after the government found that there were too few workers paying out of their salary into a pension, and, because the state pension itself is not particularly substantial, more and more people of retirement age were living with very little income if they did not have a considerable amount of savings.

By introducing the auto-enrolment initiative, employers are bound by law to enter their employees into a pension scheme and are also obliged to pay a certain amount into that scheme.

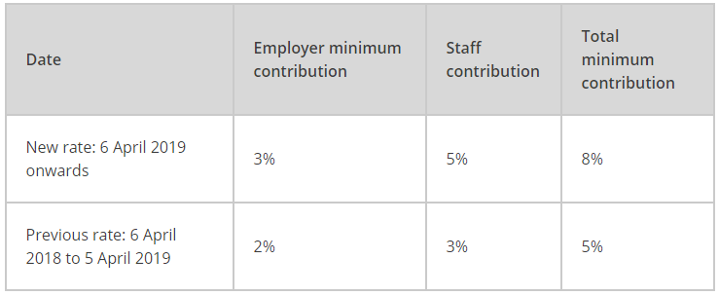

As of 6 April 2019, the minimum contributions increased as follows:

By law, the employer must contribute at least 3% to the employer’s pension pot, but the total contribution must be at least 8%. This means that either the employer can make up the remaining 5%, or the employer can choose the employee to do this. The employee does not legally have to contribute anything – but it is at the employer’s discretion as to whether they choose to cover the whole amount.

Many larger, private-sector companies choose to cover the total minimum contribution and more; some companies use high pension contributions as a pull-in factor when recruiting for new staff.

It is up to you how much you’ll contribute (as long as you’re meeting the minimum), and your accountant will be able to help you decide.

Who does auto-enrolment apply to?

An employee who fits all of the following criteria must be auto enrolled:

- Aged between 22 and state pension age;

- Earns £10,000 or more per year;

- Works in the UK.

Anybody outside these criteria does not need to be auto enrolled – so, for example, a 21-year-old earning £21,000 year or a 38-year-old earning £9,000 a year would not have to be enrolled into any pension scheme, though it is always a good benefit to offer!

In terms of employers, under the Pensions Act 2008, all employers are legally obliged to sign up to a scheme where they have at least one employee who fits the criteria above. You may, however, be unsure as to whether you are an employer if you have contractors working for you. An employer deducts tax and National Insurance Contributions (NICs) from its employees, whereas if you have contractors working for you whose agency or limited company handles the tax aspect, you are not considered an employer. It is important, though, that you double check with HMRC if you are unsure at all about your status as an employee.

If you need help and advice understanding you Pension obligations as an employer, please get in touch.

Written by:

Nicola J Sorrell -

Effective Accounting

Founder | Xero Champion | IR35 Expert

Share this post: