Why is bookkeeping so important?

Posted on 18th March 2021

When it comes to bookkeeping, we believe keeping good financial records is essential to running a successful business. So, whether you’re an obsessive filer or a suck-it-and-see type when it comes to admin, eventually you will need a system that works for you.

As a business owner you will need to keep a track of your income, expenses and cashflow. If you need assistance, we offer bookkeeping as a standalone service or as an add-on to one of our packages.

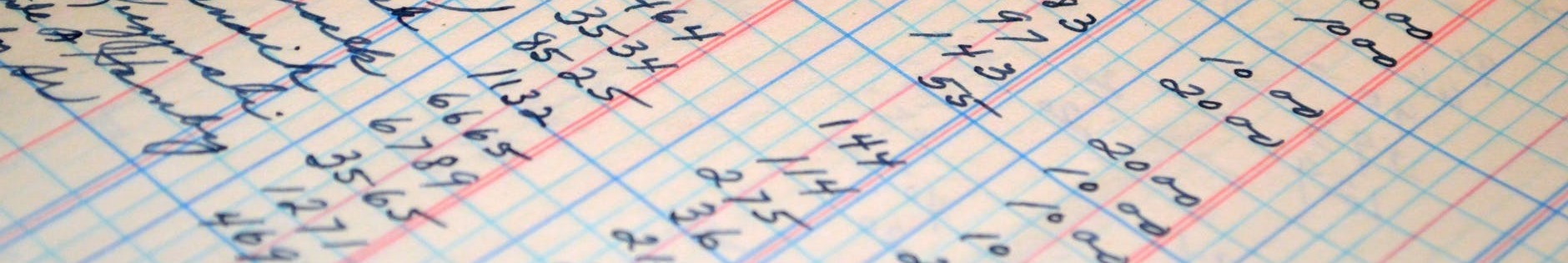

What is bookkeeping?

Bookkeeping is all your business’ financial transactions recorded in a way that’s easy to see what money is coming in, what is going out, who you owe and who owes you.

This record is important because part of running a successful business is for you to be able to make enough money to pay yourself, employee salaries, suppliers and taxes, as well as make a profit.

We advise that you get into the habit of balancing your books from the very first month you go into business.

Below are some of the reasons why we feel bookkeeping it’s so important.

Why is bookkeeping so important?

Having a sound understanding of your company finances is vital to your success and longevity. You need to understand the financial performance and position of the business to know whether to invest further funds, whether your profit margins are right and whether you are ultimately making a profit.

Having your bookkeeping up-to-date means you can see at glance not only what money you have in the bank; but what money is due to come in from customers – so you can chase if needed, and what money is due out to suppliers – to ensure you can meet their payment terms.

There will be a number of tax payments that you will need to make throughout each financial year, and you will need to have put aside enough money to cover these. These include:

Corporation tax

Income Tax

National Insurance

VAT

Business Rates

Not all of these taxes will apply to your business, depending on whether you’re a limited company or a sole trader and also how much revenue you make. Read our blog post about what taxes does a small limited company owner have to know about? for more information on which of these taxes apply to you.

Having accurate and up to date bookkeeping will allow you to work out how much tax you own before the bill is due. Allowing you to put aside the correct amount in advance.

With accurate bookkeeping you can prepare VAT returns, accounts and Tax Returns promptly to confirm any taxes due and with minimum time taken away from growing your business.

You may choose to employ an accountant to do your bookkeeping for you. This is one of the services we offer, and we can also assist you with:

Accounts

VAT

Tax Returns

Payroll

Tax Planning

Management Accounts

IR35 Advice & Contract Review

Company Secretarial

Once your bookkeeping is in order, you and your accountant will be able to make tax-efficient decisions around things like your business structure, whether you should be VAT registered and how much you pay yourself.

How we can help

You can contact us and we’ll help you through the required records needed for accurate bookkeeping.

Written by:

Nicola J Sorrell -

Effective Accounting

Founder | Xero Champion | IR35 Expert

Share this post: