Corporation Tax Rate Changes - From April 2023

Posted on 6th February 2023

The Autumn Budget 2022 saw the planned rise in the Corporation Tax Rate confirmed and to be effective from April 2023. Corporation Tax is currently 19% (for all sizes of limited company), but this will rise to 25% with marginal relief for companies with profits between £50,000 and £250,000. Sound confusing? Here we look at what Corporation Tax is, who pays it and what the changes mean for limited companies.

What is Corporation Tax?

Corporation Tax is a tax paid by UK limited companies and other types of organisations, including clubs, societies, and associations.

Businesses that find themselves subject to Corporation Tax must prepare and submit accounts and a Corporation Tax return each year. The deadline for filing the tax return is 12 months after the end of the financial year, but the business must pay the Corporation Tax due 9 months and 1 day after the end of the financial year - meaning you pay the Corporation Tax before the filing deadline (crazy, eh?!)

How is Corporation Tax calculated?

Corporation Tax is calculated based on the profits of the business. This is where the accounts and Corporation Tax come in.

Once the business prepares it's financial accounts for the year, it then prepares the Corporation Tax return and calculates the tax due. There are often some tax adjustments needed to ensure tax regulations have been followed, particularly around some disallowable expenses and capital allowances (this is where your accountant comes in!)

What is the Corporation Tax rate and what is changing?

The Corporation Tax rate is confirmed each year in the Budget and has been set as 19% since 2017.

In the 2021 Budget, held on 3 March 2021, Rishi Sunak announced a rise in Corporation Tax rate to 25% (effective 1 April 2023). Controversially, with the political turmoil and economic uncertainty of 2022, this was scrapped in the Mini Budget on 23 September 2022 by then Chancellor, Kwasi Kwarteng - and just weeks later the Government made a dramatic u-turn announcing on 14 October 2022 that the CT rise will go ahead as originally planned. What a mess!

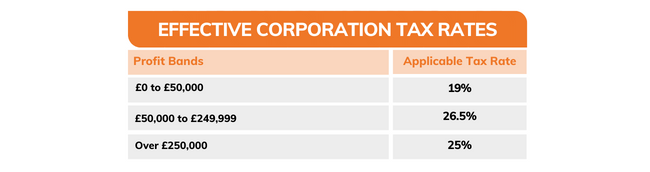

However - it isn't that simple (is it ever?!). The actual Corporation Tax rate a business will be subject to will depend on their profit. So, from 1 April 2023:-

Businesses with profits under £50,000 ("lower limit") will see their Corporation Tax rate remain at 19% (known as the "small profits rate")

Businesses with profits over £250,000 ("upper limit") will see their Corporation Tax rate rise from 19% to 25% (known as the "main rate")

Businesses with profits between £50,000 and £250,000 will calculate their Corporation Tax at 25% (known as the "main rate") but will then claim marginal relief which tapers the rate increase. For this, see examples below.

To confuse things further, the Corporation Tax rates are based on the fiscal tax year (April to April). As a business may have a different financial year, part of the business' financial year may straddle the old rules and the new incoming changes - meaning that for a business' next financial year, some of the profits may be taxed at the old rate of 19%, and some at the main rate of 25% (with some tapered relief if profits are between £50,000 and £250,000).

A few other complications

As ever, it is never quite that simple - there are a few other complications:-

If your company is considered to be a Close Investment Holding Company (CIHC) you will pay Corporation Tax at the main rate of 25% regardless of your profit.

The lower and upper limits are proportionately reduced for short accounting periods.

The lower and upper limits are reduced depending on the number of associated companies the company has. This is to stop companies avoiding the main rate by splitting the business into multiple companies.

So, yes - it is getting complicated!

Marginal Relief (for when profits are between £50,000 and £250,000)

Marginal Relief for Corporaton Tax (MSCR) tapers the effect of the increased rate.

Many small businesses, particularly clients of Effective Accounting, will find that their profit level sits between £50,000 and £250,000 leaving them with a confusing calculation (see below) and unable to easily estimate their Corporation Tax.

However, the simplest way to calculate the Corporation Tax is by using the effective rates below:-

The formula for calculating Marginal Relief is:

(Upper Limit - Profits) x Basic Profits/Profits x MSCR fraction

- Upper Limit is £250,000

- Basic profits are the companies trading profits/gains

- Profits are Basic Profits plus Franked Investment Income (FII is generally Dividends from other companies)

- MSCR Fraction is 3/200ths

Example: £60,000 annual profits.

(£250,000 - £60,000) x £60,000/£60,000 x 3/200 = £2,850

So, the Corporation Tax will be:-

£60,000 x 25% = £15,000

Less Marginal Relief of £2,850

Corporation Tax due £12,150

Summary

We appreciate that these changes are confusing and the calculations are complicated. Ultimately, it is much more complicated for business owners to estimate their Corporation Tax than previously - but we will support all our clients in managing and navigating these changes.

If you have any questions on this, please get in touch!

Written by:

Nicola J Sorrell - Effective Accounting

Founder | Xero Champion | IR35 Expert

Share this post: